- Millions of people on classic mobile contracts are overpaying for their phones, further adding to the cost-of-living crisis

- Three of the four UK mobile network operators (EE, Vodafone, and Three) are continuing to charge millions of customers for their handsets long after customers have finished paying for them.

- A new study has found that close to a third (32%) of Millennial and Gen Z adults still have their parents pay for their phone bill. The operator is urging bill payers to check their monthly outgoings to make sure they aren’t paying for something they already own.

- Virgin Media O2 automatically rolls down its direct customers’ contracts once they’ve paid off their devices ensuring they don’t pay more than they should for their phone.

London, UK – December 06 2023 A poll of 1,000 adults aged 18 to 35 found almost a third (32 per cent) still have their phone bill paid for by their mum and dad, while 35 per cent also use their logins to TV streaming services.

Other bills paid for by the bank of mum and dad include utility bills (30 per cent), housing costs (32 per cent) and even insurance policies (22 per cent).

The research comes as Virgin Media O2 warns consumers that smartphone overpayments exceed more than £530m a year.

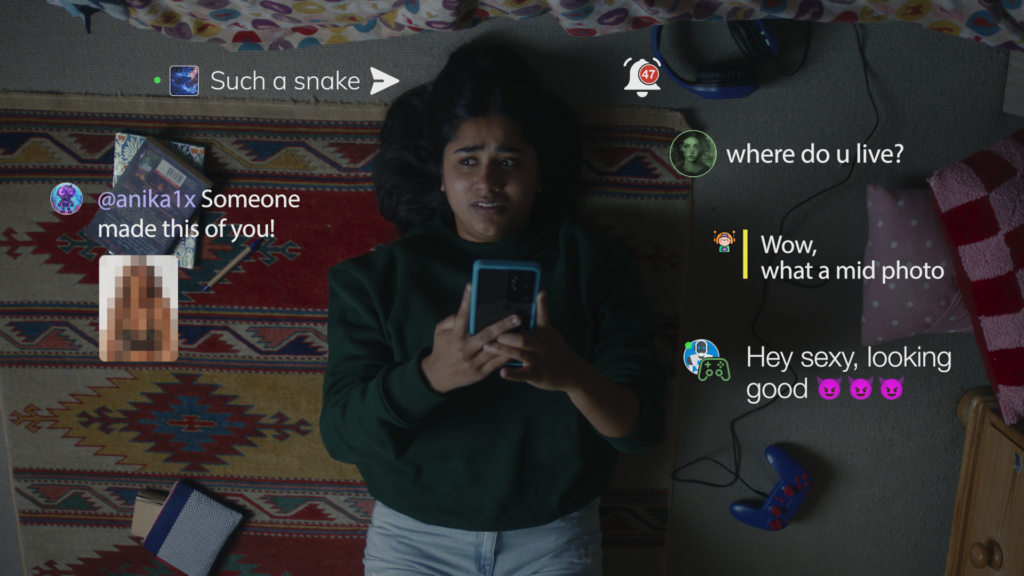

Millions end up overpaying for their smartphones once they fall out of contract because network providers don’t fully or automatically reduce every customers’ bills once they’ve paid for the cost of the phone, meaning they’re continually charged for something they already own.

Rob Orr, Chief Operations Officer at Virgin Media O2, which commissioned the study to warn parents they could be overpaying on their children’s phone bills, said: “In the current economic climate, people can ill afford to waste money paying for phones they already own.

“Whether you’re getting support from the bank of mum and dad or helping your kids, we’re urging everyone to check you’re not being charged for a phone that’s already been paid off.

“Many parents across the UK will be paying for multiple phone contracts so it’s crucial they avoid the pernicious practice of smartphone overpayments.”

It also emerged in the research that the cost-of-living crisis is biting for the younger generation, with those polled estimating their bills have risen on average by £154.49 since the start of 2023 and parents contributing £46.10 a month or more than £550 a year on average to their offspring’s coffers.

More than a quarter (26 per cent) said they felt guilty about taking money from their parents and 38 per cent worry their parents might cut back their financial support in the next year.

The generational divide was apparent with 12 per cent stating they expected their parents to help out financially.

Almost half (45 per cent) believe money went further in their parents’ generation with more than half (55 per cent) believing it’s harder to get on the property ladder than it was 10 years ago.

The research also revealed the differing opinions of those depending on the bank of mum and dad and those who fly solo. Millennials and members of Gen Z who don’t receive financial support are 40 per cent more likely to view mortgages as expensive today compared to those on the parental payroll.

They’re also 38 per cent more likely to describe inflation as too high compared with those who enjoy the extra budgetary backing.

However, young people also report helping their parents financially, with 37 per cent of 18 to 35-year-olds paying for some of their parents’ bills or subscriptions, according to the research carried out via OnePoll.

TV streaming services such as Netflix (37 per cent), utility and phone bills (both 33 per cent) are among the most common things the younger generations cover for their parents.

The main drivers for supporting their parents include being able to help and feeling like they should (38 per cent), wanting to show they love them and wanting to give back (both 37 per cent) after their parents supported them growing up.

Rob Orr, Chief Operations Officer for Virgin Media O2, which has created an online mobile overpayment calculator so consumers can check in seconds if they have overpaid for their smartphones, added: “With the cost of living crisis continuing to bite, it’s more important than ever to make sure you’re only being charged for what you owe.

“If you buy your phone directly from O2, we’ll automatically reduce your bill once your contract ends so you don’t pay a penny more than you should for your handset.”

“Millions are overpaying for smartphones on deals with other providers which have already run their course and with the average impacted consumer overpaying by around £200 a year, parents paying for multiple contracts could be shelling out hundreds for phones that are already rightly theirs.”

press enquiries

press enquiries